Higher interest rates remains the only option to stem the ringgit’s continued decline since Kuala Lumpur has ruled out pegging as in 1998 and the possibility of 1MDB "defaulting" on its loans looms.

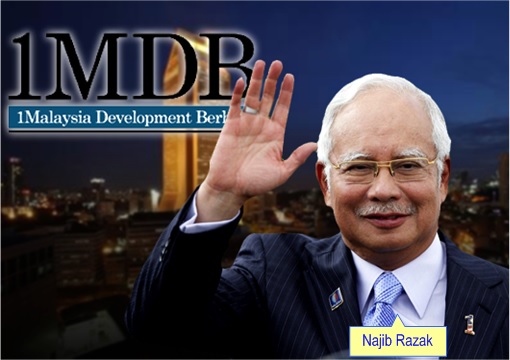

KUALA LUMPUR: New disclosures on Wednesday on the trouble-stricken 1Malaysia Development Berhad (1MDB), reports CNBC, are being cited as the reason for the ringgit continuing to plunge despite China’s monetary stimulus measures calming the currency market. The ringgit is at a 17-year low on foreign exchange markets.

“Already, foreign investor sentiment has in fact been dogged by concerns on the ringgit since late last year as the possibility of 1MDB defaulting on its loans looms in the wake of the crude oil and commodity markets being on a downward trend.”

Jesper Bargamn, head of trading for Nordea Bank in Singapore, told CNBC that “everybody is revising downwards their forecasts for the ringgit. Right now, we are in a panicky situation and nobody wants to touch it (ringgit).”

Mirza Baig, the head of foreign exchange and interest rates strategy for Asia at BNP Paribas, sees higher interest rates as the only option to stem the ringgit’s continued decline since Kuala Lumpur has ruled out re-introducing capital account controls, or pegging, as in 1998 during the Asian Currency Crisis.

CNBS cited Business Times Singapore which reported on Wednesday that there was no response on its queries to 1Malaysia Development Berhad (1MDB) and the Abu Dhabi Government-owned International Petroleum Investment Corporation (IPIC) that a deal between them signed recently “was as good as off”. 1MDB, in a statement, has since denied the report that the deal was off and said that talks continue.

Quoting a “reliable” source, BTS reported on Wednesday that “the deal is good as off”.

CNBC ventured that the worries in the market are that 1MDB will default on its massive loans. “In that case, the Ministry of Finance (MoF) Malaysia under Prime Minister Najib Abdul Razak would be held responsible. If the Business Times Singapore report is true, the exit of IPIC would sap any remaining investor confidence in 1MDB and usher in fresh blows for the ringgit.”

Even without 1MDB, the news portal pointed out that the ringgit has been buffeted by the crude oil and commodity markets heading south, China’s recent renminbi devaluation and an external debt pile that has exceeded 60 per cent of the GDP.

Briefly, the deal signed in late May, between 1MDB, the Ministry of Finance (MoF) Malaysia, IPIC and its subsidiary Aabar Investments, saw the Arabs also providing the Malaysian company with USD1 billion to repay a syndicated loan from jittery banks in Singapore which demanded early settlement. 1MDB is being touted as a strategic investment and development arm of MoF.

The plan was part of a broader one whereby both IPIC and Aabar would cover the interest payments on 1MDB’s USD3.5 billion worth of bonds but on an interim basis, forgive any debt owed by the company to IPIC/Aabar, and eventually take over the debt papers once the trouble-stricken Malaysian company transfers to the Arab parties, corresponding assets issued by it in 2012 to fund the purchase of power assets, and are guaranteed by IPIC.

Business Times Singapore reported that it could not be immediately determined what led to the Arabs “changing their minds on the deal” with the Malaysians but noted that Prime Minister Najib Abdul Razak courted bad press by sacking his deputy, Muhyiddin Yassin, and stonewalling a parliamentary committee’s probe into the company. “IPIC could plug the plug on the plan to help restructure some USD3.5 billion of 1MDB debts.”

BT also cited the Gulf Times as saying that “unease was growing in the Middle East” over the lingering and growing 1MDB controversy which has thrown the media spotlight on its dealings with Middle East parties who are growing jittery at the expose bringing them to public attention. That reportedly led to the departure of Aabar Investments’ top executives, at first Chairman Khadem al-Qubaisi and recently Chief Executive Mohamed Badawy al-Husseiny, from the firm.

“The news that some USD681 million which entered Najib’s personal accounts was a political donation from an unnamed Middle Eastern party, and not from 1MDB, left everyone befuddled.”

The USD681 million, noted BTS, in fact moved from the Singapore branch of Aabar-owned Falcon Bank, a Swiss private bank, into Najib’s accounts.

By Lin KayKay

No comments:

Post a Comment